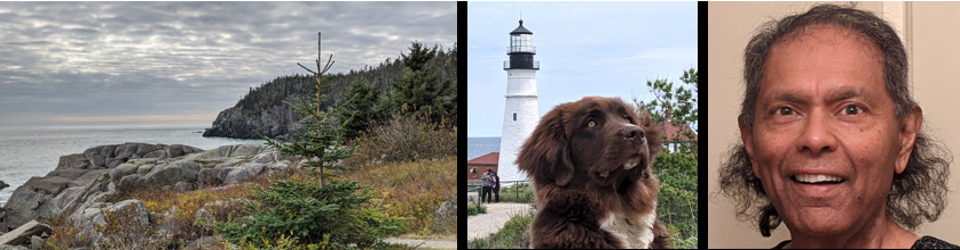

by Anura Guruge

on May 14, 2024

Follow Anura Guruge on WordPress.com

Wow.

I don’t dispute too many charges, BUT I am, however, assiduous in doing so IF I get screwed. I do not like being taken advantage of. That said, at most, I might file less than a handful of disputes a year on the 400 or more charges I make on credit cards each year. [Easy to work out that figure. I make AT LEAST one charge a day. SMILE]

I am new to ‘Wells Fargo’. They offered me a 0% APR deal that I would have been a bigger fool than I normally are to turn down. SMILE. The credit cards I use the most are from ‘Bank of America‘ — & I have been a customer of theirs since I arrived in the States in 1985. [They bought out ‘Bank of Maryland’ my first U.S. bank — as an adult.]

I very rarely (& I mean VERY, VERY rarely) lose a credit card dispute. I am scrupulously honest & I think ‘they’ kind of know that. I don’t (as I have already kind of mentioned) file too many disputes. But, with BofA I am used to disputes dragging on for weeks & getting multiple letters in the post. NOT SO with WF.

I am immensely impressed & glad. WOW. Much to be said for this.