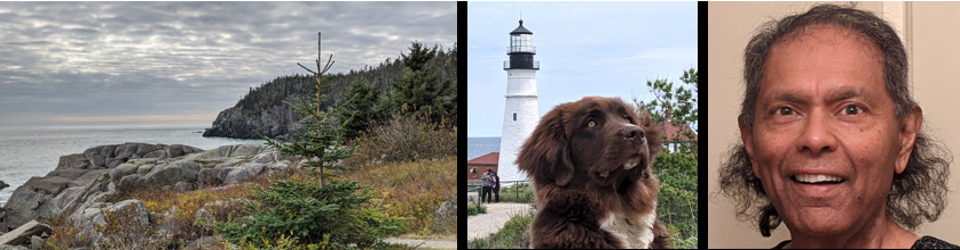

by Anura Guruge

on July 4, 2021

This is NOT right, or kosher, by any measure. There is a very real potential that a lot of U.S. investors could end up losing a lot of money.

NO, I did not buy DIDI. Just did NOT have a good feeling about them. I have seen too many recent IPOs tank after the first few days of exuberant euphoria. I was going to wait & see what happens. I told a few people, by e-mail, that I was going to wait until it dropped to the $13 range (i.e., below the IPO price). Instead of buying DIDI, I did, however, buy a few shares of ‘XMTR‘ which IPOed on the same day. It hasn’t done great as yet, but I like its ‘story’ — i.e., it locates spare manufacturing capacity for those looking for manufacturing sources.

But, back to DIDI.

This looks like a clever (but nasty) trick by the Chinese to hurt American investors & cock a snook at President Biden. The U.S. must react. You can’t let them get away with it.

Their timing also couldn’t have been accidental. They did it on July 4th. That alone is significant. But, to make it worse, July 5 is a holiday in the U.S. with the stock markets closed. So, investors in other countries, including China, can react to the news while U.S. investors fret.

Not nice. Not good. China is getting more & more brazen.