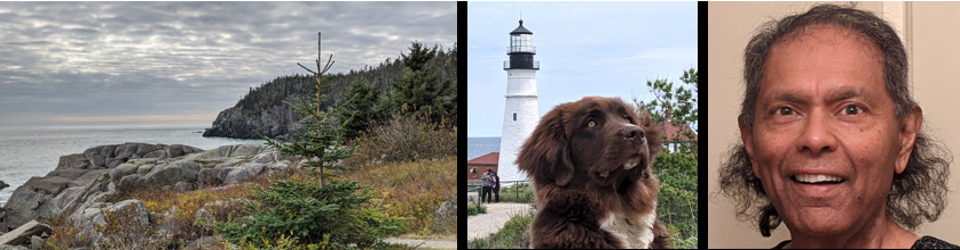

by Anura Guruge

on April 5, 2024

From 2021 (below).

Ran into this problem again with my daughter’s return. Yes, we trade stock options on her account. SMILE. Come on. It is like printing money. Why wouldn’t you trade, if you can.

I will readily admit that NEGATIVE ‘Total Proceeds’ is esoteric & unusual BUT it happens as I have been moaning about for the last 4 years. Yes, it is counter-intuitive. I will readily grant you that. Yes, it basically says you sold some investment instruments at a negative value. So, how does that happen. This mostly happens with option trading. When you option loses money & then it expires or is bought at a loss.

I confess, often, to being addicted to option trading. That the proceeds are NEGATIVE does NOT mean we are losing money. SMILE. SMILE again. Most times getting a negative return is good — you make some money & get a tax break. SMILE. What can I say. It is all legal.

Free File Fillable Forms might not work for you. Be careful.