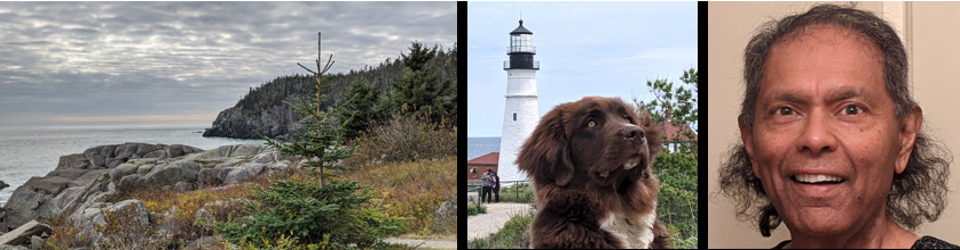

by Anura Guruge

on February 8, 2023

My contention, & it is just that, is that AMZN & GOOG would have fared BETTER in this down market IF NOT for the 20-to-1 splits!

Yes, of course, in early 2022 (i.e., last year) we all expected that AMZN & GOOG will go gangbusters after their 20-to-1 splits. LOT of folks bought these shares ahead of the splits on this assumption — which had been the case in prior, high-profile splits.

With interest rates shooting up (to curb inflation) this has been a difficult & down market. That is a given.

But, I am THINKING that AMZN & GOOG would have been more resilient IF NOT for the split. Why? The 20-to-1 split change the demographics of the ownership.

Prior to the split you basically had to be rich to own a chunk of AMZN or GOOG. When AMZN was $3,000 you needed $300,000 in order to own 100 shares. Not so after the split. You could own 100 for a mere $15,000.

AMZN & GOOG were no longer exclusive.

Let me be blunt. After the split, riff-raff were able to afford these shares. They trade differently than the more refined investor.

That is my thesis. We DEVALUED the ownership.

Just like a neighbourhood. If the prices drop by a factor of 20 the ownership profile will shift dramatically. That is my point.

I am not sure whether this can ever be tested or proved.

But, something to THINK about.