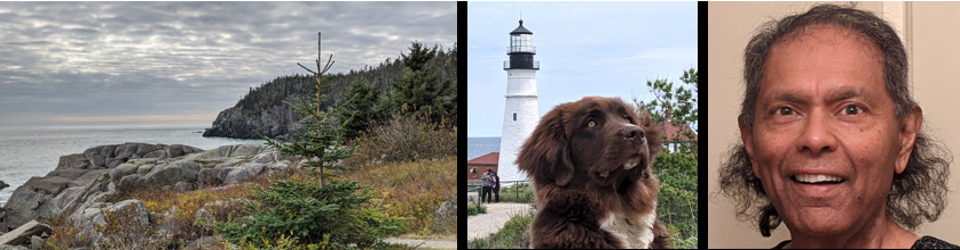

by Anura Guruge

on June 27, 2023

Follow Anura Guruge on WordPress.com

I even got this last month SAYING that I would get ZERO, i.e., $0.00, royalty on some of my books. Yes, I had to increase the list price — as of last week. BUT, even with that. $0.96 on a $23 book — i.e., 4%.

I am NOT complaining — not that complaining will get me anywhere.

I am VERY FORTUNATE that I don’t have to rely on any monies I make from my books — for anything. I survive trading options. {SMILE} It is hard life, but I have to make living.

But, I feed bad for those who want to make living as authors. IF you are mega-successful you are FINE. Very fine. If you sell 10,000 books, your .96 cents, will be $9,600. That is not bad.

Yes, royalties are better on eBook BUT I hate eBooks.

What cracks me up is that everyone makes MORE MONEY selling my books than I do!

That is kind of crazy. But, I am OK with that. I can ask for more money & insist that they make less. But, it is not in I to do that. Runs in the family.

I am, among my many faults, is NOT GREEDY when it comes to money (just food, wine & you know what {SMILE}). I am THANKFUL everyday that I am not greedy when it comes to money. From what I can see, those that are tend to be miserable, daily. That I am NOT. SMILE.

38 of my 39 Published Books.