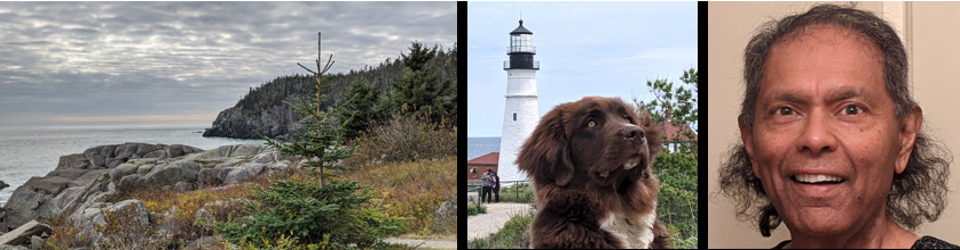

by Anura Guruge

on June 13, 2022

Follow Anura Guruge on WordPress.com

The last few months have been painful but some of us old folks have lived through similar (if not worse). So, I no longer panic. Most of all I no longer sell in a panic. I will ride it out, just like I did 2008 to 2012.

These are extraordinary times. Inflation is brutal. The Fed left it way too long to stop buying treasuries (to boost bond rates) & raise rates. Now they don’t have any choice but to raise rates — though I am sure that raising rates alone will not curb inflation, in a hurry, this time around. A unique set of criteria — supply chain disruption key among them. Inflation will continue to rise as long as we have supply issues. Moreover, we are also faced by a labor shortage. That means wages will go up. That always drives up inflation. So, I do NOT see a short-term fix. I am ready & prepared for prolonged pain for the remainder of this year.

From what I can see, the worst is yet to come! [SORRY]

That said there are quite a few, as of today, THINKING that the Fed will hike rates on Wednesday by 0.75% or even a 1%. That would be quite the thing. If they do we will see another HUGE drop in the market. Investors will FLEE. We will see even further tightening of ‘margin debt’ forcing folks to sell more shares to cover their debt.

BUT, if the Fed only hikes rates 0.50% many will feel a sense of relief. A mistaken belief that inflation may have peaked. (It hasn’t.) But, we will see a HUGE relief rally. But, it won’t, alas, last. [SORRY]